Report Overview

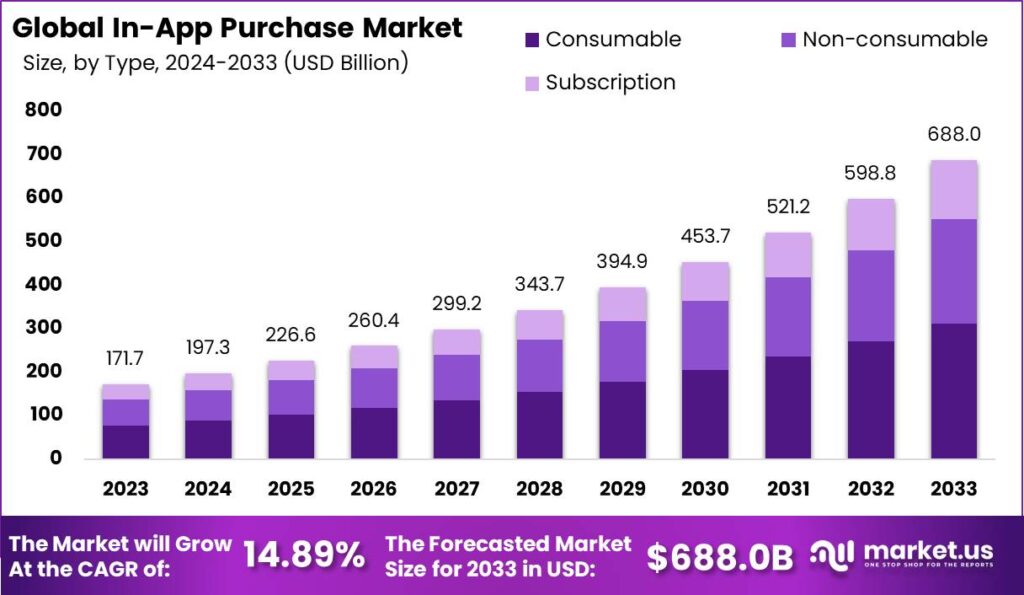

The Global In-App Purchase Market size is expected to be worth around USD 688.0 Billion By 2033, from USD 171.7 Billion in 2023, growing at a CAGR of 14.89% during the forecast period from 2024 to 2033. In 2023, North America was the leading region in the in-app purchase market, commanding over 38% of the market share and generating USD 65.2 billion in revenue.

In-app purchases (IAP) refer to the buying of goods and services from inside an application on a mobile device, such as a smartphone or tablet. These purchases can range from additional content, digital goods, subscriptions, and enhancements within the app itself. The In-App Purchase market encompasses the economic activities surrounding these transactions across various app platforms.

The in-app purchase market is driven by the extensive adoption of smartphones and the growing prevalence of mobile applications. Gaming, especially, is a significant segment where users frequently buy virtual items such as game currencies or power-ups. Besides gaming, there’s rising demand within applications for health and fitness and entertainment, where users are willing to pay for premium content and features. The ease of making purchases within an app, coupled with the heightened user engagement that many apps are aiming for, contributes significantly to the market’s growth.

The market for in-app purchases is ripe with opportunities, especially in the integration of these systems with e-commerce platforms and the expanding mobile gaming sector. Technological innovations are continually shaping this market. For instance, newer payment integration methods that enhance user convenience and security are pivotal. Moreover, platforms like iOS and Android are constantly updating their systems to create more seamless and secure environments for in-app purchases, thus encouraging more users to engage with this revenue model.

Key Takeaways

- The Global In-app Purchase market is projected to reach approximately USD 688.0 billion by 2033. It is expected to grow from USD 171.7 billion in 2023, achieving a compound annual growth rate (CAGR) of 14.89% during the forecast period from 2024 to 2033.

- In 2023, the Android segment held a leading position in the in-app purchase market, accounting for over 56% of the total share.

- The consumable segment was a significant contributor in 2023, capturing more than 45.2% of the market share.

- The gaming segment dominated the in-app purchase market in 2023, representing over 60% of the total share.

- North America was the leading region in the in-app purchase market in 2023, holding more than 38% of the market share and generating USD 65.2 billion in revenue.

Operating System Analysis

In 2023, the Android segment held a dominant position in the In-App Purchase Market, capturing more than a 56% share. This leadership can be attributed to the widespread adoption of Android devices globally, especially in emerging markets.

Android’s open-source nature makes it more accessible to a broad range of manufacturers, resulting in a wide variety of devices at different price points. This affordability increases Android’s penetration in less affluent regions, where consumers are more likely to engage with free apps that offer in-app purchases as a way to enhance functionality or user experience.

Another reason for Android’s leading position in the market is the scalability and customization it offers to developers. The Android platform allows for a high degree of customization in apps, which enables developers to create diverse and engaging in-app purchase options tailored to a wide audience. This flexibility also encourages innovation, with developers experimenting with various monetization strategies that appeal to a broad user base.

Moreover, Google Play Store’s relatively less stringent publishing policies compared to Apple’s App Store play a significant role. These policies allow a larger volume of apps to be available on the Android market, providing users with more opportunities to make in-app purchases. The ease of integrating various payment gateways also enhances the user’s ability to make purchases within apps, supporting the segment’s growth.

Type Analysis

In 2023, the Consumable segment held a dominant market position within the In-App Purchase market, capturing more than a 45.2% share. This segment includes items that users can purchase once and use within mobile apps or games, such as virtual currency, power-ups, or additional lives.

The appeal of Consumable in-app purchases stems from their ability to immediately impact the user’s enjoyment and progress in an app or game. For developers, these types of purchases offer a steady revenue stream, as they encourage repeated buying behavior. The success of this model is visible in the proliferation of mobile games and entertainment apps that rely on microtransactions for monetization.

The surge in mobile device usage and the increasing integration of sophisticated payment solutions within apps simplify the purchasing process, making it more convenient for users to make in-app purchases. This ease of transaction fuels the growth of the Consumable segment, as users are more likely to engage in impulse buying.

Overall, the Consumable segment’s lead in the In-App Purchase market is supported by the growing consumer inclination towards engaging and interactive app content, which frequently necessitates or benefits from these types of purchases. As long as apps continue to captivate users’ interests and provide value through in-app consumables, this segment is expected to maintain its market dominance.

Application Analysis

In 2023, the Gaming segment held a dominant market position in the In-App Purchase Market, capturing more than a 60% share. This significant market share can be attributed to the immersive and engaging nature of gaming apps, which effectively utilize in-app purchases to enhance user experience.

Gamers are typically willing to spend on virtual goods, such as skins, characters, and in-game currency, to improve their gaming experience or gain a competitive edge. This willingness is bolstered by the continuously evolving game designs that incentivize purchases within an interactive environment.

The success of the Gaming segment is also driven by the integration of sophisticated game mechanics and reward systems that encourage repeated transactions. Developers often implement tiered rewards and limited-time offers that create a sense of urgency and exclusivity, prompting users to make purchases. These strategies are particularly effective in mobile games, where the ease of making transactions via smartphones facilitates spontaneous buying decisions.

Key Market Segments

By Operating System

By Type

- Consumable

- Non-consumable

- Subscription

By Application

- Gaming

- Entertainment & Music

- Health & Fitness

- Travel & Action

- Social Networking

- Finance

- Others

Driver

Growing User Engagement with Mobile Applications

A key driver behind the In-App Purchase (IAP) market’s expansion is the surge in user engagement within mobile applications. With smartphone penetration reaching new heights globally, people are spending more time on mobile applications than ever before. From gaming to productivity and social networking, mobile apps have become essential in daily life, leading to a strong demand for enhanced features and personalization.

The growth of mobile gaming has been a significant contributor to the IAP market. Games are among the highest revenue-generating categories, where players buy items, character upgrades, or premium game levels. With advancements in digital payment technologies, the IAP process has also become more streamlined, reducing friction and enabling users to complete transactions securely. The convenience of integrated payment methods, like Apple Pay and Google Pay, have boosted the adoption of in-app purchases across various demographics.

Restraint

Privacy and Security Concerns

Privacy and security issues serve as a notable restraint in the growth of the In-App Purchase market. As users share sensitive information, such as credit card details and personal data, in-app transactions have raised concerns over data protection. Frequent headlines about data breaches or unauthorized transactions have led many users to hesitate when making purchases within apps, as they worry about the security of their personal information.

The complexity of payment ecosystems and the involvement of multiple parties (e.g., app developers, payment processors, and device manufacturers) can expose data to potential risks. Unauthorized third-party apps or malicious software might intercept payment data, leading to fraud or identity theft. Additionally, regulatory bodies worldwide have increasingly imposed strict regulations, requiring developers to enhance data protection measures.

Opportunity

Expanding Markets in Emerging Economies

Emerging economies offer substantial growth opportunities for the In-App Purchase market. With increasing internet connectivity, smartphone penetration, and digital literacy, markets in regions like Southeast Asia, Latin America, and Africa are poised to become significant contributors to in-app purchases.

In these areas, mobile devices are often the primary means of accessing the internet, making mobile apps an integral part of everyday activities, from entertainment to education and even financial management. Many app developers are now targeting these regions by adapting their offerings to local preferences and price sensitivity. Gaming, streaming, and e-learning apps are particularly popular, where users are willing to pay for additional features, ad-free experiences, or exclusive content.

Localized pricing strategies have also proven successful, as developers offer tiered in-app purchase options that align with the average income levels in emerging economies. By providing lower-cost options, developers can tap into a vast user base that may not have previously considered making in-app purchases.

Challenge

Intense competition in the market

The In-App Purchase market faces the formidable challenge of intense competition, which has significant implications for app developers and platform providers. With millions of apps available across various categories, standing out in a crowded marketplace is increasingly difficult. Users often have multiple options within the same category, which reduces chances of choosing an app that heavily relies on in-app purchases over free or more affordable alternatives.

Monetization strategies must be carefully balanced to avoid user dissatisfaction. Aggressive in-app purchase tactics can lead to frustration among users, who may view excessive prompts or high costs as “paywalls.” Many users are sensitive to the perceived value of their purchases, especially in gaming and productivity apps, where they expect genuine benefits or rewards.

Emerging Trends

The In-app purchase market is rapidly evolving with several key trends shaping its future. One significant trend is the integration of advanced technologies like augmented reality (AR) and virtual reality (VR) which are enhancing user experiences and opening new avenues for app monetization. For example, AR features in apps allow users to try products virtually before purchasing, significantly boosting in-app sales.

Another emerging trend is the rise of “super apps” that consolidate multiple services within a single platform, such as messaging, social media, and payments, facilitating more integrated and frequent in-app purchases. This model is particularly popular in Asia but is gaining traction globally as users seek more comprehensive digital experiences from single applications.

Additionally, the proliferation of subscription models across various app categories from entertainment to productivity tools is reshaping consumer spending habits. Users are increasingly willing to pay for subscriptions that offer continuous access to content or services, thereby providing app developers with a steady revenue stream.

Business Benefits

In-app purchases offer several business benefits, helping companies to tap into lucrative revenue streams. They allow businesses to monetize their applications beyond the initial download, particularly through microtransactions in gaming or premium features in productivity apps. This model not only boosts revenue but also enhances user engagement by providing valuable additions that enhance the core app experience.

Moreover, in-app purchases enable businesses to gather detailed data on user preferences and behavior, which can be used to tailor marketing strategies and improve product offerings. This data-driven approach helps in refining user experiences and increasing customer satisfaction and retention.

The flexibility of in-app purchasing models, such as consumables, non-consumables, and subscriptions, provides businesses with the versatility to address various user needs and preferences, thereby widening their market reach and potential customer base. Each model caters to different aspects of consumer behavior, from one-time enhancements to ongoing service access, aligning with broader trends in digital consumption.

Regional Analysis

In 2023, North America held a dominant market position in the In-App Purchase Market, capturing more than a 38% share and generating USD 65.2 billion in revenue. This leading stance can be primarily attributed to the high smartphone penetration and the widespread use of mobile applications across various sectors including gaming, entertainment, and e-commerce.

The prevalence of key tech giants and innovative startups in North America also plays a critical role in this dominance. Companies based in this region are often at the forefront of introducing cutting-edge features that leverage in-app purchases, such as augmented reality and advanced gaming elements.

This innovation drives higher user engagement and spending.The region’s robust digital infrastructure supports seamless transactions and enhances user experience, encouraging more frequent and higher-value purchases.The region also benefits from a tech-savvy consumer base that is more inclined to adopt new technologies and spend on digital enhancements within apps.

Additionally, the cultural inclination towards digital consumption in North America facilitates greater expenditure on in-app purchases. The market is supported by sophisticated advertising strategies and monetization models that are tailored to encourage users to spend more within apps. Marketing campaigns are highly targeted, using data analytics to personalize offers and maximize conversion rates.

Overall, North America’s lead in the In-App Purchase Market is bolstered by advanced technology adoption, a strong presence of influential tech companies, and a consumer culture that embraces digital spending. These factors are likely to sustain its market dominance going forward, supported by ongoing technological advancements and strategic market activities.

Key Regions and Countries

- North America

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Player Analysis

In-app purchases (IAP) have become a crucial part of the mobile app economy, allowing developers to offer additional features, content, or subscriptions within their apps. The major key players plays a vital role in creating a seamless experience for users and maximizing revenue opportunities for developers.

Apple Inc. stands out as a key player in the In-App Purchase Market, leveraging its robust ecosystem to facilitate transactions across its vast array of apps. Apple’s App Store offers a secure and streamlined payment process that encourages users to make purchases with confidence. The company has successfully capitalized on its large, loyal customer base, who are typically more willing to spend on digital goods and services.

Epic Games Inc. has made significant inroads into the in-app purchase sphere primarily through its flagship product, Fortnite. The game’s free-to-play model, combined with a continuous stream of fresh content and in-game items, has proven highly effective at encouraging users to make purchases. Epic Games uses events, collaborations, and limited-time offers to keep the game engaging and to prompt ongoing spendings.

Google LLC (Alphabet Inc.) is another major influencer in the In-App Purchase Market with its Google Play Store, which serves as a platform for millions of Android applications. Google’s strength lies in its vast reach and the Android operating system’s large market share, especially in emerging markets. The company has optimized the in-app purchase process through Google Play Billing, which supports a wide range of payment methods globally.

Top Key Players in the Market

- Apple Inc.

- Epic Games Inc.

- Google LLC (Alphabet Inc.)

- King.com Limited (Activision Blizzard Inc.)

- Netflix Inc.

- Rakuten Group Inc.

- Sony Corporation

- Spotify Technology S.A.

- Tencent Holdings Ltd.

- The Walt Disney Company

- Tinder (Match Group Inc.)

- Other Key Players

Recent Developments

- In January 2024, Netflix is exploring ways to monetize its gaming venture, including in-app purchases, premium pricing, and ads. Recent discussions among executives suggest a potential shift in strategy to generate revenues from gaming. Some of the ideas under consideration include introducing in-app purchases, charging extra for more sophisticated games, or providing access to games with ads for subscribers on the newer ad-supported tier.

- In January 2024, Spotify expressed interest in launching in-app purchases, contingent upon changes in Apple’s App Store policies, particularly in light of new European Union regulations.

- In October 2024, Apple integrated Klarna, a buy now, pay later (BNPL) service, into Apple Pay. This allows users to make purchases in four interest-free installments. The move follows the closure of Apple’s own BNPL service, Pay Later, earlier in 2024.

- In October 2024, Microsoft plans to update its Xbox mobile app on Android, allowing U.S. users to purchase and play Xbox games directly on their devices starting in November 2024. This change follows a U.S. court ruling requiring Google to open up the Play Store to competition.

- In October 2024, Disney+ and Hulu stopped supporting in-app purchases through Apple’s App Store, aiming to avoid the 15-30% commission fees. The goal is to turn streaming into a “growing business” by reducing the “cost of customer acquisition” and cutting marketing costs.

Report Scope