Written by Jason Snell

October 17, 2024, 12:17 PM Pacific Time

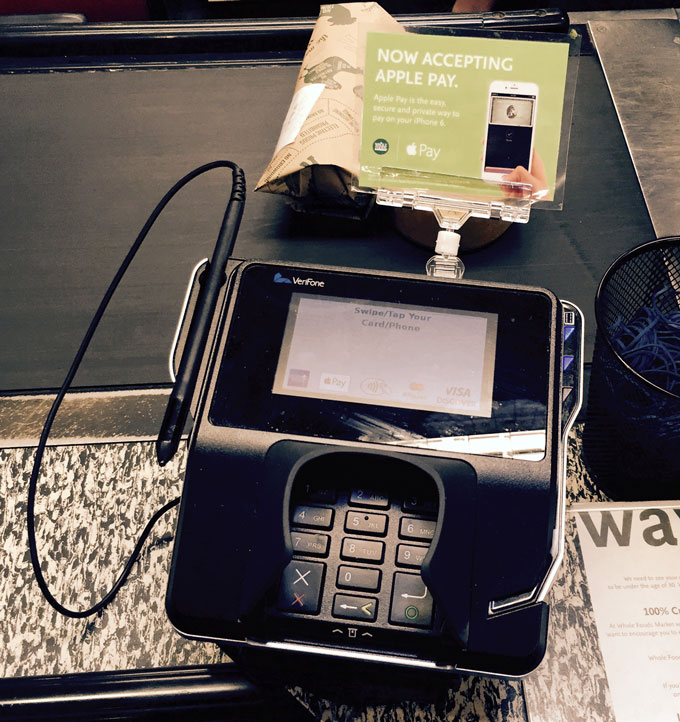

It’s hard to believe that Apple Pay was launched 10 years ago, but it’s kind of cool that it’s gotten to the point where I can link back to my story from 10 years ago about the first time I used Apple Pay at my local Whole Foods. It’s just hard to believe.

“Oh, would you like to try that?” Tyler said.

“Yes, I am one of them,” I said, habitually placing my thumb over the phone as if trying to unlock it. I was going to do that, but instead I paid for the groceries.

“Hey, I don’t know what happened,” Tyler said as a paper receipt popped out of the cashier’s printer.

Today, Apple posted a Newsroom PR item celebrating this milestone, while also announcing a few new things: additional installment loan support and expanded benefits support on participating cards. Unfortunately, there are very few cards that participate in this program, and I think Discover is the only one in the US, but it does mean that you can apply Discover cashback and miles directly to your Apple Pay purchases if you want. is.

In the US, Apple Pay has had the effect I expected. Tap to pay is now commonplace in a way it wasn’t before. In this respect, the United States is now slightly less out of step with the rest of the world. Rapid transit support has also made a huge difference in about 20 cities.

But I’m surprised that Apple’s other financial products, Apple Card and Apple Cash, are basically going nowhere. These are still only available in the US. Apple’s economic influence appears to be reaching its limits.

If you enjoy articles like this, please support us by becoming a Six Colors subscriber. Subscribers get access to exclusive podcasts, members-only stories, and a special community.