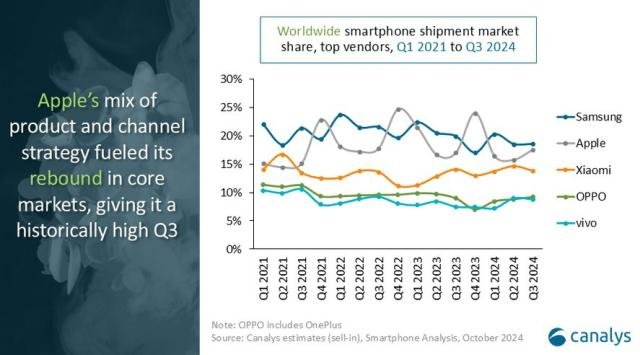

According to research by Canalys, global smartphone shipments in the third quarter of 2024 increased by 5% year-on-year to a total of 309.9 million units, marking the best performance since the third quarter of 2021.

Smartphone Market Growth Q3 2024 Samsung took first place with shipments of 57.5 million units, supported by an optimized entry-level lineup. Samsung had a 19 percent share of the global smartphone market in Q3 2024, compared to 20 percent in Q3 2023. Samsung shipped 58.6 million smartphones in Q3 2023.

Apple secured second place with a record 54.5 million units, largely driven by the successful launch of the iPhone 16 series in emerging markets. Apple’s share of the global smartphone market was 17% in Q3 2023, compared to 18% in Q3 2024. Apple had shipped 50 million iPhones in Q3 2023.

Xiaomi followed in third place with 42.8 million units, benefiting from strategic inventory placement for new product launches. Xiaomi’s global smartphone market share was 14% in Q3 2024, but it was 14% in Q3 2023. Xiaomi shipped 41.5 million smartphones in the third quarter of 2023.

OPPO and vivo were in the top five, shipping 28.6 million units and 27.2 million units, respectively.

OPPO’s global smartphone market share was 9% in Q3 2023, compared to 9% in Q3 2024. OPPO shipped 26.4 million smartphones in Q3 2023.

Vivo’s global smartphone market share was 7% in Q3 2023, compared to 9% in Q3 2024. Vivo shipped 22 million smartphones in Q3 2023.

Apple’s third-quarter success was due to enhanced channel and supply chain optimization that enabled it to fulfill pre-orders more quickly, especially for older iPhone models. Despite this success, potential geopolitical challenges and delays in the introduction of new technology may impact future results.

Intense competition continues in the low-end market, with OPPO’s rebranded A3 series experiencing significant growth in Southeast Asia.

Rising component costs and market saturation have challenged long-term profitability, leading brands to focus on mid-market growth in emerging markets.

Xiaomi aims to leverage its brand presence to increase mid-range to high-end sales, while vivo expands its V40 series to strengthen its mid-range offerings.

Canalys is cautiously optimistic about the rest of the year, highlighting that emerging markets are outperforming the overall trend due to increased price competition. However, while inflationary pressures may hamper the profitability of the ultra-low-end segment, the growth of the luxury segment in mature markets will depend on AI-driven innovation.

Baburajan Kijakedas