Apple’s iPhone 16 launch is off to a slow start, with early sales suggesting buyers may be more interested in the 2023 model than the latest upgrade.

According to early data, the iPhone 16 model launched in September 2024 appears to be lagging behind last year’s iPhone 15 lineup. Unlike in recent years, the 2024 release closely aligns with Apple’s typical pre-pandemic launch schedule, allowing for year-over-year performance comparisons.

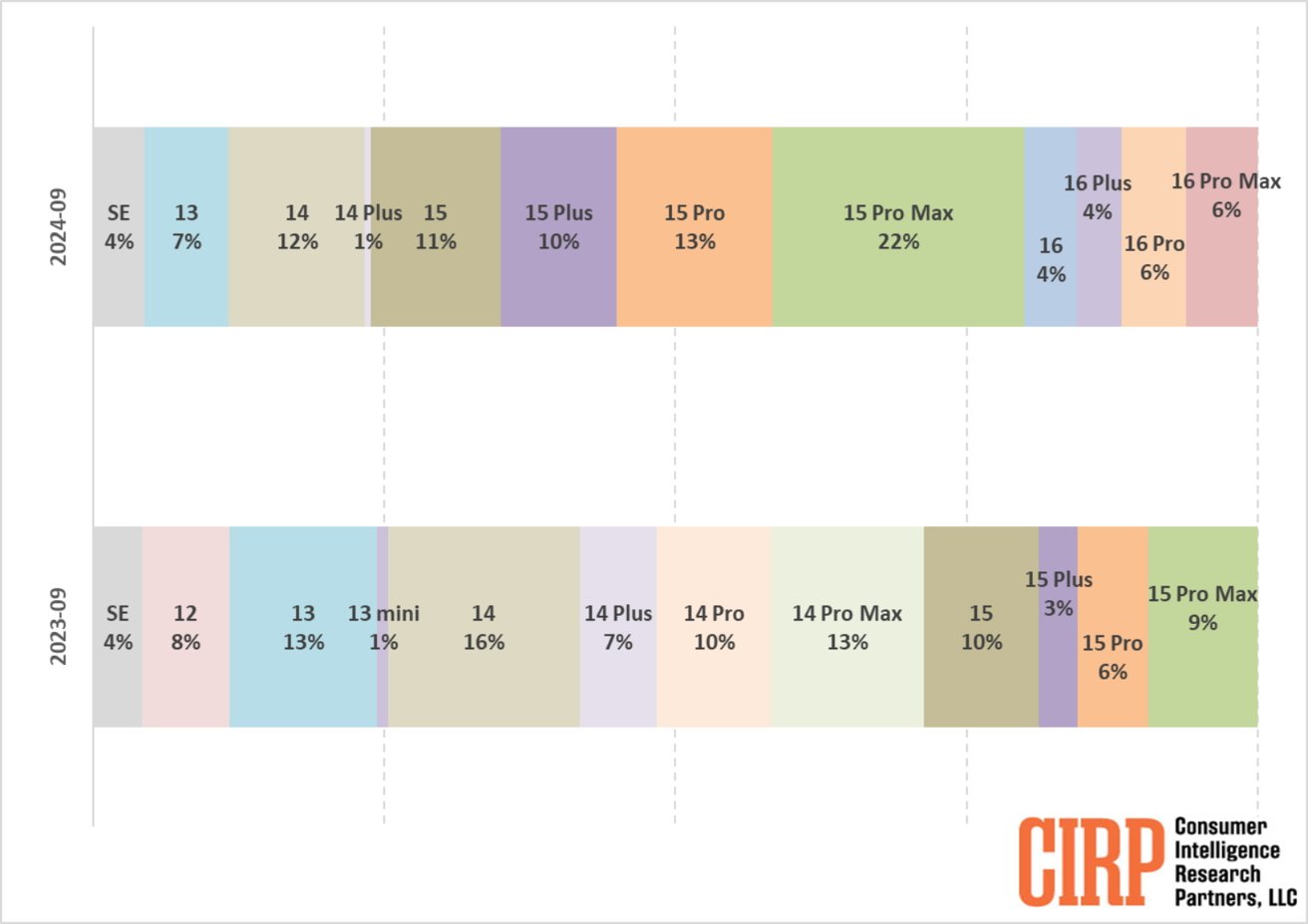

Reports, including one from Consumer Intelligence Research Partners (CIRP), reveal that initial sales of the iPhone 16 will fall short of the rapid adoption of the iPhone 15 lineup from the same period in 2023.

In the first two weeks of sales, these models collectively accounted for a 20% share of US iPhone sales. In contrast, the iPhone 15 series had a significantly higher share of 29% during the same period in 2023, indicating a noticeable decline in early adoption of the latest models.

This difference becomes even more apparent when you consider high-end models. As of September 2024, the iPhone 16 Pro and Pro Max accounted for 12% of total iPhone sales, down from the 15% share of the iPhone 15 Pro and Pro Max in the same period last year.

The shift in consumer interest from the latest releases to last year’s models is especially noteworthy, given that Apple continues to sell legacy models alongside new ones.

Distribution of iPhone models (quarters ending September 2024 and September 2023). Image credit: CIRP

The persistence of older models on the market provides further context for this trend. In September 2023, iPhone 13 and earlier models accounted for approximately 26% of U.S. sales, but in 2024, iPhone 14 and earlier models accounted for 24% of sales, with older devices having experienced a relative decline over the years. It shows that it is selected stably.

This consistency contrasts with the notable shift to the model from a year ago in 2024. In 2023, iPhone 15 models accounted for 56% of sales in the September 2024 quarter, a notable increase from the 46% share of iPhone 14 models in 2023.

A 10% increase in demand for older models suggests that consumers are reluctant to upgrade to the latest releases right away.

Analysts’ views on future performance

Analysts say Apple’s production strategy is being adjusted to accommodate these dynamics. JP Morgan reported that demand for the iPhone 16 series is stable, but slightly behind the iPhone 15 series in terms of availability and shipping timing.

In particular, the US shipping time for the iPhone 16 Pro Max has been reduced from 21 days in 2023 to 15 days in 2024, demonstrating Apple’s efforts to efficiently manage the supply of premium models.

Meanwhile, analyst Ming-Chi Kuo said demand for iPhone 16 Pro models has met Apple’s expectations, and the company will need to maintain production through China’s National Day holiday to meet orders. said. However, demand for the iPhone 16 and 16 Plus has been even weaker, and Apple has cautiously decided to reduce orders for some parts for these baseline models by an estimated 3% to 5%.

While this reduction reflects weaker demand for non-Pro models, it is unlikely to have a significant impact on overall production levels as Apple maintains steady production of its high-demand Pro models.

As the holiday season approaches, Apple may show renewed interest in the iPhone 16 Pro model in particular. This period could prompt a reassessment of the positioning and appeal of the standard iPhone 16 and 16 Plus, and could set a new direction for future product cycles.