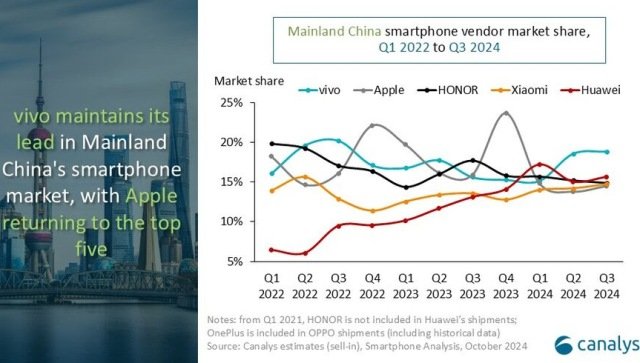

The latest research report from Canalys and IDC shows that Vivo maintains its lead in the Chinese smartphone market in Q3 2024.

canalys report

In Q3 2024, Vivo maintained its lead in China’s smartphone market with a 19% share. This is primarily due to strategic launches in the mid-range segment and dual-channel approach that has strengthened both offline sales and online presence.

According to Canalys, Vivo shipped 13 million units, up 25% year-on-year, benefiting from a market uptick from the summer and back-to-school shopping seasons.

Vivo focused on mass-market, mid-range products that appealed to budget-conscious consumers, especially students and young professionals. Vivo targeted consumers looking for an upgrade without the hefty price tag by launching an affordable 5G device that is feature-rich but also has improved durability and battery life.

Additionally, a channel strategy that balances partnering with offline retailers and expanding its online presence has helped Vivo capture both foot traffic and e-commerce demand.

While brands such as Huawei and HONOR face challenges in their respective market segments, Vivo’s steady growth, coupled with an innovative strategy to increase visibility across shopping platforms, has positioned it to tap into China’s evolving consumer base. It reflects the corresponding adaptability.

“Mainland China’s smartphone market is entering its most active period of the year, with consumer demand continuing from last quarter’s e-commerce sales into the summer,” said Amber Liu, research manager at Canalys. “Vendors are optimizing inventory and launching new products for the upcoming shopping season.”

According to Canalys, Vivo (19%), Huawei (16%), Honor (15%), Xiaomi (15%) and Apple (14%) will be the leading smartphone brands in China in Q3 2024. The size of China’s smartphone market was 69.1 million units in Q3 2024.

IDC report

In Q3 2024, Vivo leveraged a clear product strategy and dynamic market positioning to maintain its lead in the Chinese smartphone market. According to IDC, Vivo achieved a market share of 18.6% through its main brand and sub-brands targeting different demographics and needs across consumer groups.

Vivo’s strength to maintain its top position has been its ability to appeal to both mid-range and premium consumers. Its diverse portfolio, powered by continued expansion in 5G and mass market segments, has attracted many companies looking to upgrade amid a wave of pent-up demand. This product diversity has enabled Vivo to offer feature-rich smartphones for different price points, effectively reaching consumers from budget to luxury segments.

Vivo’s commitment to innovation, especially in the Android market, supported solid double-digit growth alongside competitors such as Huawei and Xiaomi. The brand has been able to differentiate itself in a crowded market by offering unique products and has strengthened its foothold through both brick-and-mortar and online channels. As the fourth quarter approaches, Vivo remains well-positioned to continue capitalizing on seasonal demand and competitive position with strategic preparations for Singles’ Day and new flagship releases.

Jacob Zhu, Research Analyst, Client Devices, IDC Asia/Pacific. “This momentum will be further strengthened by the early release of flagship models from major brands and the early kick-off of the Singles’ Day shopping festival.”

According to IDC, Vivo (18.6%), Apple (15.6%), Huawei (15.3%), Xiaomi (14.8%), and Honor (14.6%) will be the leading smartphone brands in China in the third quarter of 2024. China’s smartphone market size was 68.8 million units in Q3 2024.

Baburajan Kijakedas