NEW DELHI: Global smartphone shipments in the third quarter of 2024 rose from the same period last year, driven by a recovery in demand and the early stages of the replacement cycle in North America, China and Europe, according to a Canalys report released on Monday. It increased by 5% compared to the previous year.

According to the research firm, the July-September period marked the fourth consecutive quarter of increase.

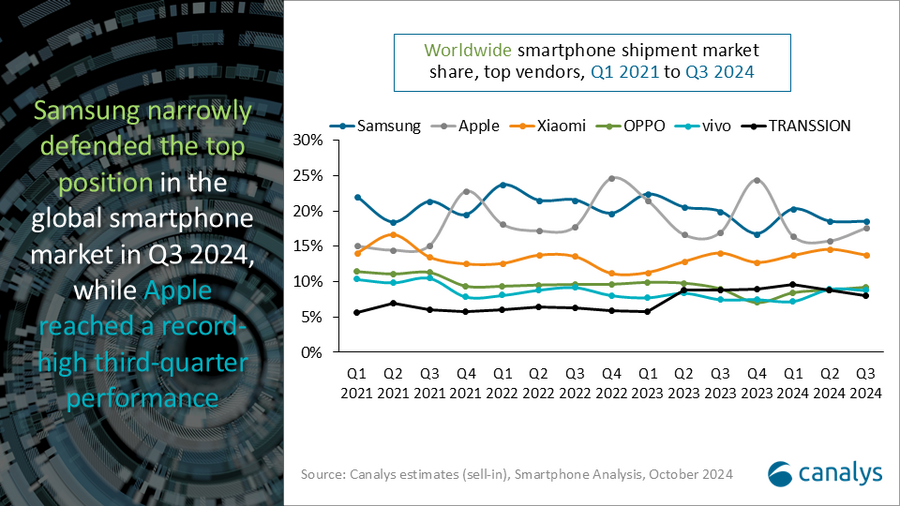

Samsung and Apple, in first and second place, each accounted for 18% of sales in the third quarter of 2024. However, the share of Korean brands declined from 21% in Q3 2023, while the share of iPhone manufacturers increased from 17% in Q3 2023. , according to Canalys data.

| Global smartphone market share is divided into two Canalys Smartphone Market Trends Preliminary: Q3 2024 |

|||

| vendor | Q3 2024 market share | Q3 2023 market share | |

| samsung | 18% | twenty one% | |

| apple | 18% | 17% | |

| xiaomi | 14% | 13% | |

| Oppo | 9% | 10% | |

| in vivo | 9% | 8% | |

| others | 32% | 32% | |

| Preliminary estimates may change in final release Note: Percentages may not total 100% due to rounding. OPPO includes OnePlus. Source: Canalys estimates (sell-in shipments), smartphone analysis, October 2024 |

|||

Xiaomi maintained its position as the third largest smartphone vendor with a market share of 14%. Oppo followed with a 9% market share, regaining fourth place in the ranking table for the first time this year, supported by strong growth in India and Latin. In the US, Vivo ranked fifth with a double-digit increase in shipments and accounted for 9% of the market. “Apple has never been closer to the top of the global smartphone market in the third quarter than it is now, with its best third quarter sales ever,” said Canalys analyst Lunar Bjorhovde. said.

Despite its modest initial reception, Björhovde said the iPhone 16 will help Apple continue to perform well through 2024 and into 2025, especially as Apple Intelligence expands into new markets and supports additional languages. It is expected that this will help build momentum in the first half of the year.

Canalys analyst Le Xuan Chiew commented, “The gap between the top five vendors is narrowing, making the competitive environment more intense.”

Although market conditions are improving, demand remains fragile as vendors face global challenges in demand generation and regulatory hurdles such as the European Union’s Ecodesign Directive.

“Effective supply chain management, maintaining healthy inventory levels, and optimizing the allocation of sales and marketing funds have become even more important for market leadership,” Chiu said.