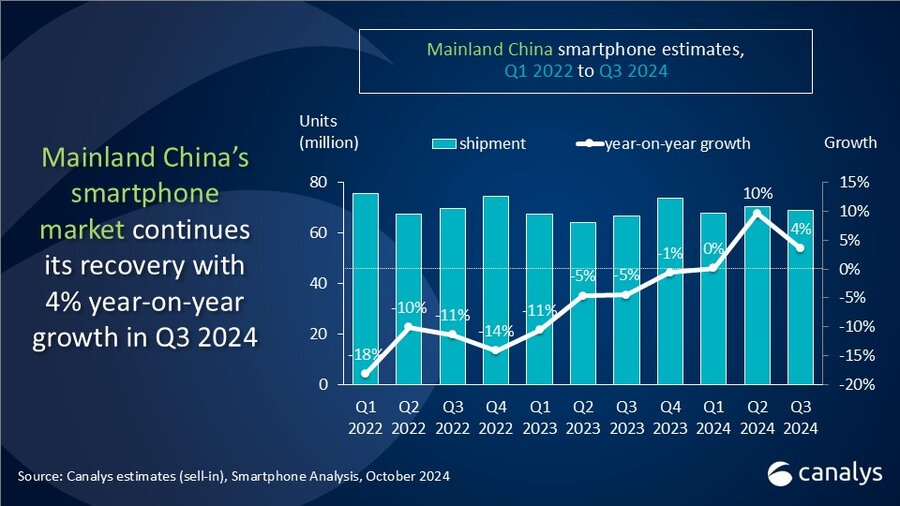

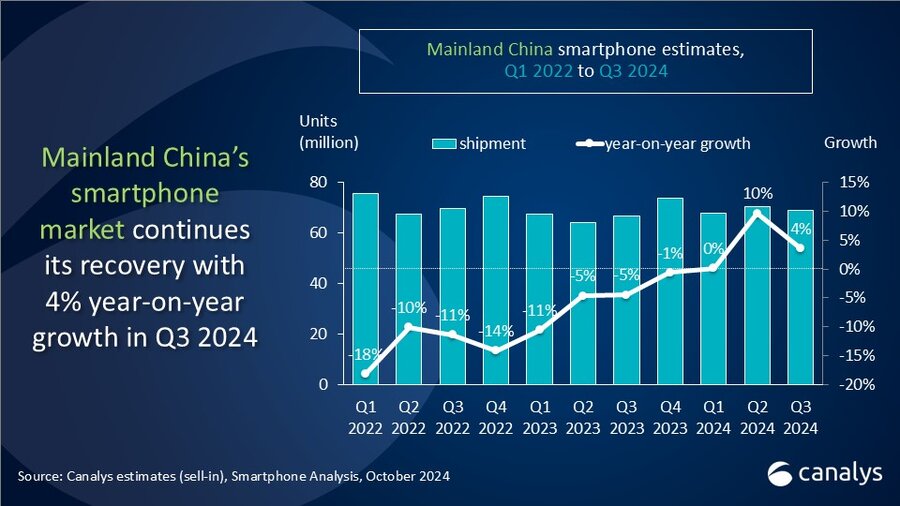

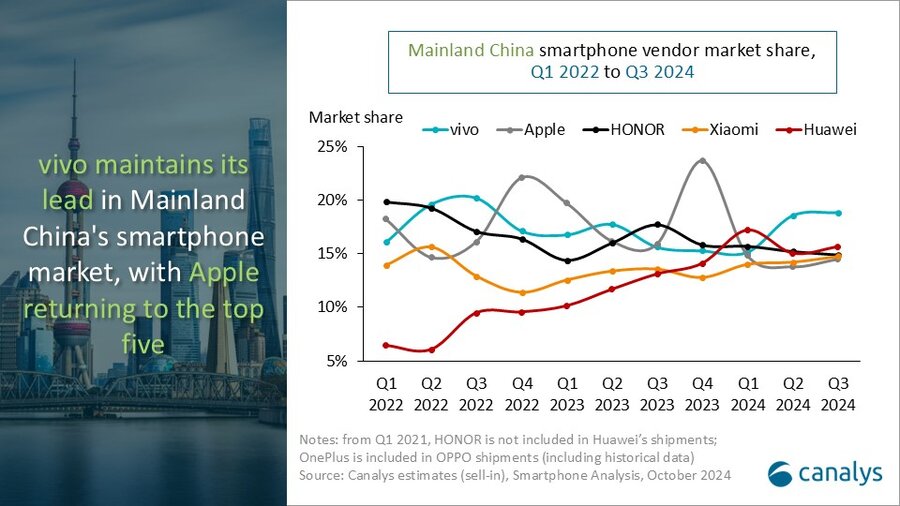

According to Canalys research, the smartphone market in mainland China continued to recover in the third quarter of 2024, driven by the summer and back-to-school shopping seasons. Shipments in the third quarter increased 4% year-on-year to 69.1 million units. vivo maintained its lead with a 19% market share as the launch of new mid-range products increased offline sales and expanded its online presence. Overall, vivo shipments reached 13 million units, an increase of 25% year-on-year. Huawei ranked second with 10.8 million units shipped, gaining 16% market share and growing 24% thanks to an aggressive channel strategy to support its core products. HONOR came in third place with 10.3 million units shipped, but faced challenges despite the popularity of new flip phones, with overall shipments down 13% year over year. Xiaomi rose to fourth place with a market share of 15%, shipping 10.2 million units and growing by 13%. Xiaomi has pursued an ecosystem strategy of “Human x Vehicle x Home” to identify a broader and more stable consumer group. Apple returned to fifth place despite a 6% decline in shipments, with demand for the iPhone 16 series expected to continue recovering even without Apple Intelligence services.

“Mainland China’s smartphone market has entered its most active period of the year, with consumer demand continuing from last quarter’s e-commerce sales into the summer,” he said. Amber Liu, Canalys Research Manager. “Vendors are optimizing their inventory and launching new products in preparation for the upcoming shopping season. In the third quarter, features such as durability, battery life, and various promotions to encourage mass-market upgrades and focus on mid-range and affordable 5G segments, which offer more options for students, the workforce, and average-income consumers to restore mass market demand. , vendors are not only ramping up their online sales efforts, but also increasing cooperation with carriers and helping offline partners improve profitability.

“The core segments are also about to reach their peak this year,” added Canalys Research Analyst Lucas Zhong. “Huawei’s Mate XT Ultimate, released in September, sparked debate around trifolds and drew attention to the upcoming Mate series. Foldable phones in mainland China have gained significant price and traffic traction. Mainland China remains the fastest growing and largest market for this new form factor. Brands like Huawei, vivo, HONOR, and OPPO are entering a new phase of AI integration, with AI-powered operating systems and AI assistants designed to improve user experience and drive demand for upgrades. A broader AI ecosystem is also taking shape, with domestic AI-enabled smartphones gaining momentum and competition expected to intensify in key segments in the fourth quarter. Masu.”

“Canalys expects the mainland Chinese smartphone market to continue its gradual recovery into next year,” Canalys senior analyst Toby Zhu concluded. “Governments have implemented accommodative monetary policies and consumer stimulus measures to boost the economy and retail industry. On the channel side, vendors are actively innovating to drive product competitiveness and technological advances in key components. They are exploring new collaboration models with major carriers and e-commerce channels, such as streaming. However, vendors are still faced with rising prices due to component costs, rapid changes in the retail industry, and geopolitics on supply chain continuity. We face significant challenges, including academic implications.”

|

Smartphone shipments and annual growth rate in the People’s Republic of China (Mainland) Canalys Smartphone Market Pulse: Q3 2024 |

|||||

|

vendor |

Q3 2024 Number of shipments (millions) |

Q3 2024 |

Q3 2023 |

Q3 2023 |

yearly |

|

in vivo |

13.0 |

19% |

10.4 |

16% |

twenty five% |

|

huawei |

10.8 |

16% |

8.7 |

13% |

twenty four% |

|

honor |

10.3 |

15% |

11.8 |

18% |

-13% |

|

xiaomi |

10.2 |

15% |

9.1 |

14% |

13% |

|

apple |

10.0 |

14% |

10.6 |

16% |

-6% |

|

others |

14.8 |

twenty one% |

16.0 |

twenty four% |

-8% |

|

total |

69.1 |

100% |

66.7 |

100% |

4% |

|

|

|

|

|||

|

Note: Starting from Q1 2021, HONOR is no longer included in Huawei shipments. OnePlus is included in OPPO shipments. |

|

||||

For more information, please contact us below.

Toby Jew: toby_zhu@canalys.com

Lucas Chong: lucas_zhong@canalys.com

Amber Liu: amber_liu@canalys.com

About smartphone analysis

canalys worldwide Smartphone analysis service provides a comprehensive country-level view of shipping forecasts much faster than our competitors. We provide quarterly market share data, timely historical data tracking, and detailed analysis of storage, processor, memory, camera, and many other specifications. We combine detailed global statistics for all categories with Canalys’ proprietary data on shipments via 1st and 2nd channels. The service also provides a unique view of end-user types. At the same time, we provide regular analysis to gain insights into the data, including the assumptions behind our forecast outlook.

About Canalys

Canalys is an independent analyst firm committed to guiding clients on the future of the technology industry and thinking beyond past business models. We provide smart market insights to IT, channel and service provider professionals around the world. We stake our reputation on the quality of our data, our use of innovative technology, and our high level of customer service.

Receiving updates

Contact us to receive media alerts directly or to learn more about our events, services, and custom research and consulting capabilities. Alternatively, you can email press@canalys.com.

Click here to unsubscribe

Copyright © Canalys. Unauthorized reproduction is prohibited.