apple (NASDAQ:AAPL) The stock is currently trading around $230, but I believe it is trading on borrowed time. Apple’s current stock price has unsupportive fundamentals, so I wouldn’t be surprised if the stock drops below $200 by the end of the year.

Apple’s business is under tremendous pressure, and unless something drastic changes, the stock price will likely correct.

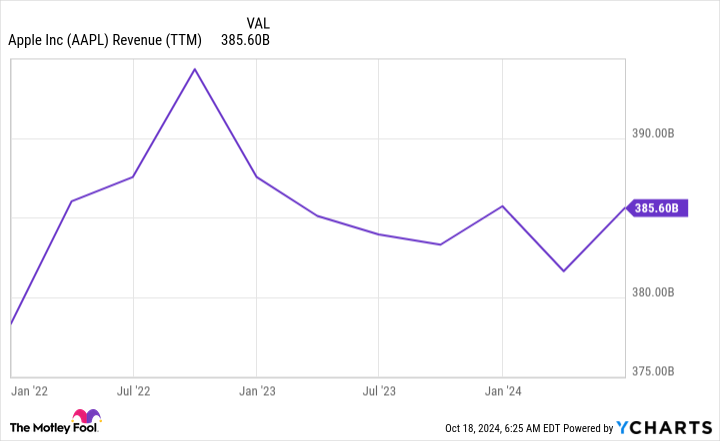

Apple’s business needs no introduction. Apple’s revenue appears to be at its peak, but the company’s devices are still in the hands of millions (if not billions) of people. Apple’s revenue hasn’t increased at all since 2022.

A company needs growth to keep its stock price rising, and Apple isn’t showing that. We’ll know more about Apple’s latest results when it reports on Halloween night (scary time to report earnings!), but the early signs aren’t very good.

Apple launched the iPhone 16 during the quarter, but multiple reports indicate that iPhone 16 sales were lower than the company expected. iPhone sales account for about half of Apple’s total revenue, so this division must be strong for the rest of the business to grow. This reported weakness has led Wall Street analysts to adjust their expectations for the coming quarter, with the consensus earnings per share (EPS) forecast dropping from $1.60 30 days ago to $1.55 now. are.

A declining outlook for earnings is never a good sign. Even if the rest of Apple’s performance is poor, don’t be surprised if the stock takes a hit, as it trades at an incredibly expensive valuation.

Apple stock carries a much higher premium than most investors realize. With a trailing P/E ratio of 35x and a forward P/E ratio of 31x, Apple stock is extremely expensive.

These companies have posted impressive growth rates while other stocks trade at higher valuations.

Over the long term, stock price movements are highly correlated with earnings growth. Therefore, if the benchmark index is S&P500 (SNPINDEX: ^GSPC) The average annual rate of return is 10%, which is the level of revenue growth that a company typically needs to consistently beat the market. if The two securities trade at the same valuation.

Last quarter, Apple’s earnings per share (EPS) grew at a 10% pace. Analysts expect 14% growth in the fourth quarter of fiscal 2024 (ending around September 30). Both numbers are either about the same as or slightly above the long-term average of the S&P 500. However, the S&P 500 trades at 24.7 times forward earnings and 23.8 times forward earnings, giving Apple a 43% and 32% premium to the respective valuation metrics.