key bank Analyst Brandon Nispel said in September: apple company AAPL The iPhone carrier survey was slightly weaker, with key first-look data showing positive results.

iPhone 16 sales in September were slightly below in-store expectations and normal seasonal trends, according to a carrier survey of analysts.

Demand for iPhone 16 Pro and iPhone 16 Max remained relatively strong due to camera upgrades, but base models remained weak.

Also read: Apple iPhone 16, delivery schedule stable and demand gaining momentum: Analyst

Store inventory is down to one day’s worth of inventory (DOI), which is above the level at last year’s launch. Apple AI was still not a near-term demand driver.

Key first-look data reflects increased iPhone demand, with Apple Store iPhone spending up 15% year-over-year in the first 10 days of launch and 7% year-over-year over launch weekend.

Indexed spending growth in September was 22% month-on-month, higher than the three-year average of 2%, according to Nispel’s key first-look data.

The year-on-year spending index accelerated to 7% from a 10% decline in August. Additionally, when comparing the first 10 days of a new iPhone’s launch to a comparable year ago, the results were 12% year-over-year, but quickly declined.

The analyst noted that two additional days of iPhone availability compared to last year benefited the company’s results. Additionally, he noted that the company benefited from sales of the iPhone 15 before the launch of the iPhone 16 and a slight improvement in initial demand year-over-year.

Nispel noted that the combined results of the September carrier survey and key first-look survey were neutral for Apple’s supply chain. Broadcom Co., Ltd. AVGO, Cirrus Logic Cruz, Qualcomm Corporation QCOM, Corbo Co., Ltd. QRVO and Skyworks Solutions Co., Ltd. S.W.K.S..

Nispel maintains an overweight rating on Broadcom, with a price target of $210, based on 36x 2025 consolidated EPS of $5.90. Broadcom’s forward consensus P/E ratio is 29x, and its average P/E ratio over the past three years has been 18x.

The analyst reiterated his Overweight rating on Cirrus Logic and set a price target of $165, based on 2026 EPS estimates of $8.65, or 19 times. Cirrus Logic has a consensus P/E of 16x and a forward consensus P/E of 14x over the past three years.

He maintained Qualcomm’s estimate and sector weight rating with a fair value of $167, based on 15 times fiscal 2025 EPS of $10.89. Qualcomm trades at a forward consensus P/E of 15x, but its average P/E over the past three years has been 13x.

Mr. Nispel reiterated that Qorvo’s sector-weighted fair value rating is $100, based on 14x FY26 EPS estimates of $6.95. Qorvo trades at a consensus forward P/E ratio of 13x. In contrast, the average over the past three years is 13x.

The analyst maintains a sector weight on Skyworks Solutions, with a fair value of $95, based on 15x 2025 EPS estimates of $6.25. Skyworks Solutions trades at a forward P/E of 15x, with an average P/E of 11x over the past three years.

Mr. Nispel’s $216 fair value for Apple is based on his 21.8 times 2025 adjusted EBITDA and roughly 18.5 times the big tech companies. Apple currently trades at approximately 22.7 times 2025 adjusted EBITDA.

Price action: As of last check on Tuesday, Apple stock was up 1.43% to $224.85.

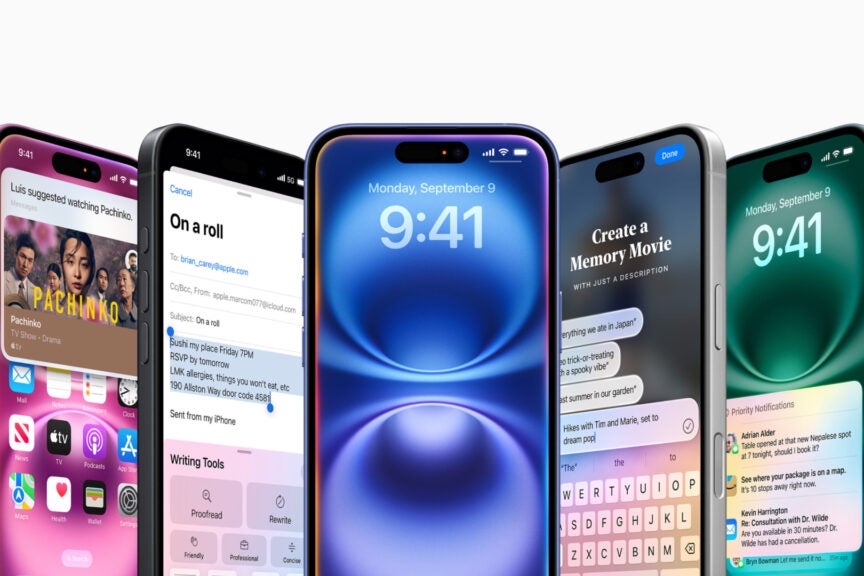

Photo via Apple

Market news and data powered by Benzinga API

© 2024 Benzinga.com. Benzinga does not provide investment advice. Unauthorized reproduction is prohibited.