new york

CNN

—

The U.S. Consumer Financial Protection Bureau ordered Goldman Sachs and Apple to pay $89 million, and Goldman was temporarily barred from issuing new credit cards due to mismanagement of the companies’ Apple Card partnership. This failure left customers with unresolved billing disputes and, in some cases, inaccurate credit reports.

According to the CFPB, Apple failed to forward tens of thousands of Apple Card disputes to Goldman Sachs. According to the CFPB, when Apple notified Goldman of the dispute, “the bank failed to comply with numerous federal requests to investigate the dispute.”

Government watchdog says both companies prematurely launched credit card efforts despite third-party warnings that dispute system was not ready for prime time due to technical issues He said he did.

“As a result of these failures, consumers faced long wait times for refunds on disputed charges, and some consumers had false negative information added to their credit reports,” the CFPB said in a statement. said.

The CFPB also found that the companies misled customers about interest-free payment plans for Apple gadgets, including the iPhone. Apple touted the card’s no fees, including annual fees, over-the-limit fees, late fees, and foreign transaction fees. However, the purchase was not interest-free.

An Apple spokesperson said in a statement that while the company strongly disagrees with the CFPB’s characterization of Apple’s conduct, it nevertheless stands by the CFPB’s order.

“Apple Card is one of the most consumer-friendly credit cards available, specifically designed to support users’ financial health,” a spokesperson said. “Apple learned about these inadvertent issues years ago and worked closely with Goldman Sachs to quickly address the issue and assist affected customers.”

Goldman Sachs said in a statement that it was pleased to be able to reach a resolution with the CFPB on this matter.

A Goldman Sachs spokesperson said: “We are working diligently to address the specific technical and operational challenges we have experienced since launch and have already addressed the affected customers.”

Goldman was fined $45 million and must pay $20 million in restitution to its clients. Apple was fined $25 million.

The CFPB also prohibited Goldman Sachs from issuing new credit cards “unless it can provide a credible plan that the products will actually comply with the law.”

The bank disclosed in a 2022 SEC filing that the CFPB is investigating its “credit card account management practices,” including its handling of refunds and billing disputes.

The fine is another blow to Goldman’s struggling consumer finance business. The company also ended its credit card partnership with General Motors earlier this year, replaced by Barclays.

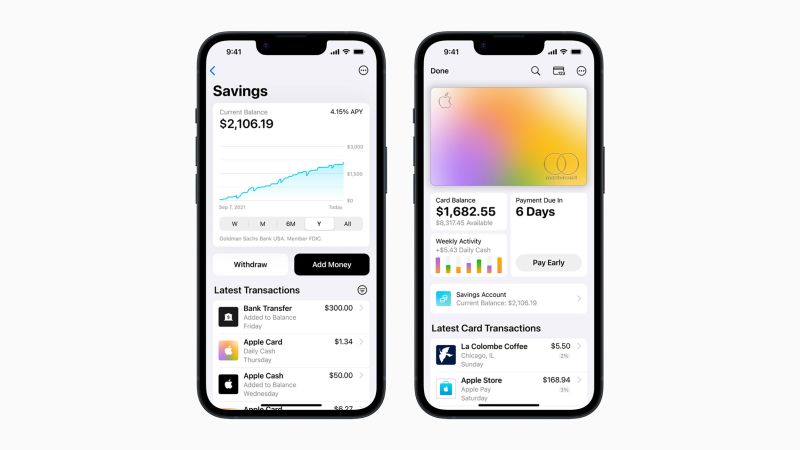

The Apple Card, issued by Goldman Sachs and operated by the Mastercard network, was rolled out in August 2019. By September 30 of that year, Goldman had already lent out about $10 billion, and customers had outstanding loans of $736 million.

Goldman entered the consumer retail business in 2016 after creating the online Marcus brand. Marcus provided unsecured personal loans, including to consumers with credit card debt.

In April 2023, Apple announced that it would offer Apple Card holders a 4.15% high-yield savings account with Goldman Sachs. You can keep both the 3% cash back you receive on select purchases using your Apple Card and any other savings you want to deposit.