New Delhi: India’s smartphone market will grow by a whopping 12% YoY in Q3 2024, driven by premiumization trend with more consumers buying expensive artificial intelligence (AI). This was the highest ever for a single quarter. According to a new report released Wednesday by Counterpoint Research, more and more smartphones are compatible with smartphones from Samsung, Apple and others.

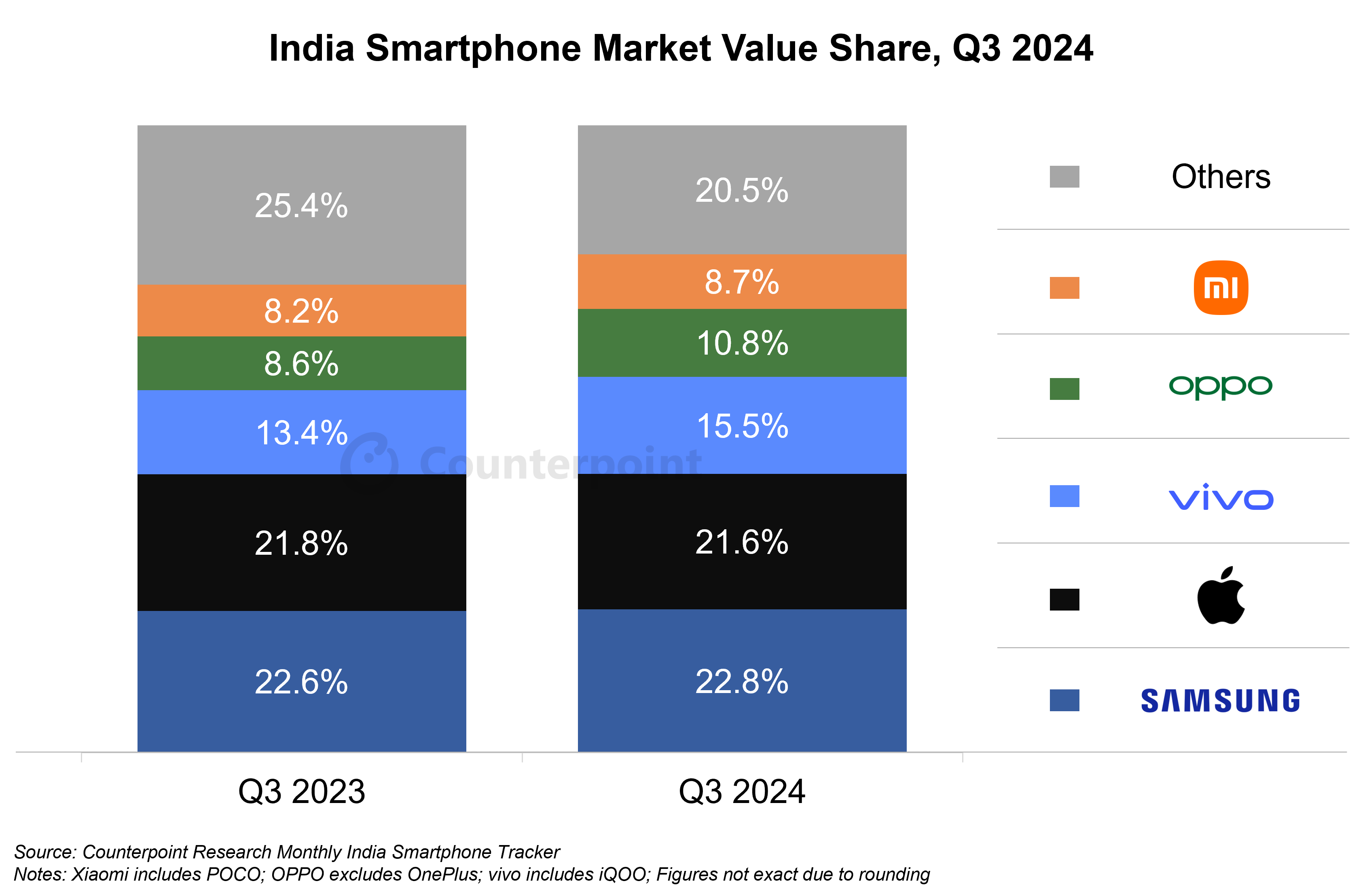

Samsung gained a 22.8% share in the July-September quarter, leading the market ( (on a monetary basis) and took the top spot. The A-series has affordable premium models on sale in the mid-range, encouraging consumers to upgrade to higher-priced segments, the research firm said.

Apple drove significant value growth through aggressive expansion into smaller cities and increased focus on new iPhones, trailing Samsung in second place with a value share of 21.6%. According to market trackers, its performance has further improved with its flagship iPhone 15 and iPhone 16 ahead of the holiday season.

“The market is increasingly shifting towards value growth, driven by premiumization trends, supported by aggressive EMI offers and trade-ins,” said Prasheel Singh, Senior Research Analyst. ” he said. “As consumers increasingly invest in premium smartphones, Apple’s ambitious image and expanding footprint solidify its position as the first choice for premium buyers in India,” he said. added.

Vivo, Oppo, and Xiaomi rounded out the top five chart in the value market with shares of 15.5%, 10.8%, and 8.7%, respectively.

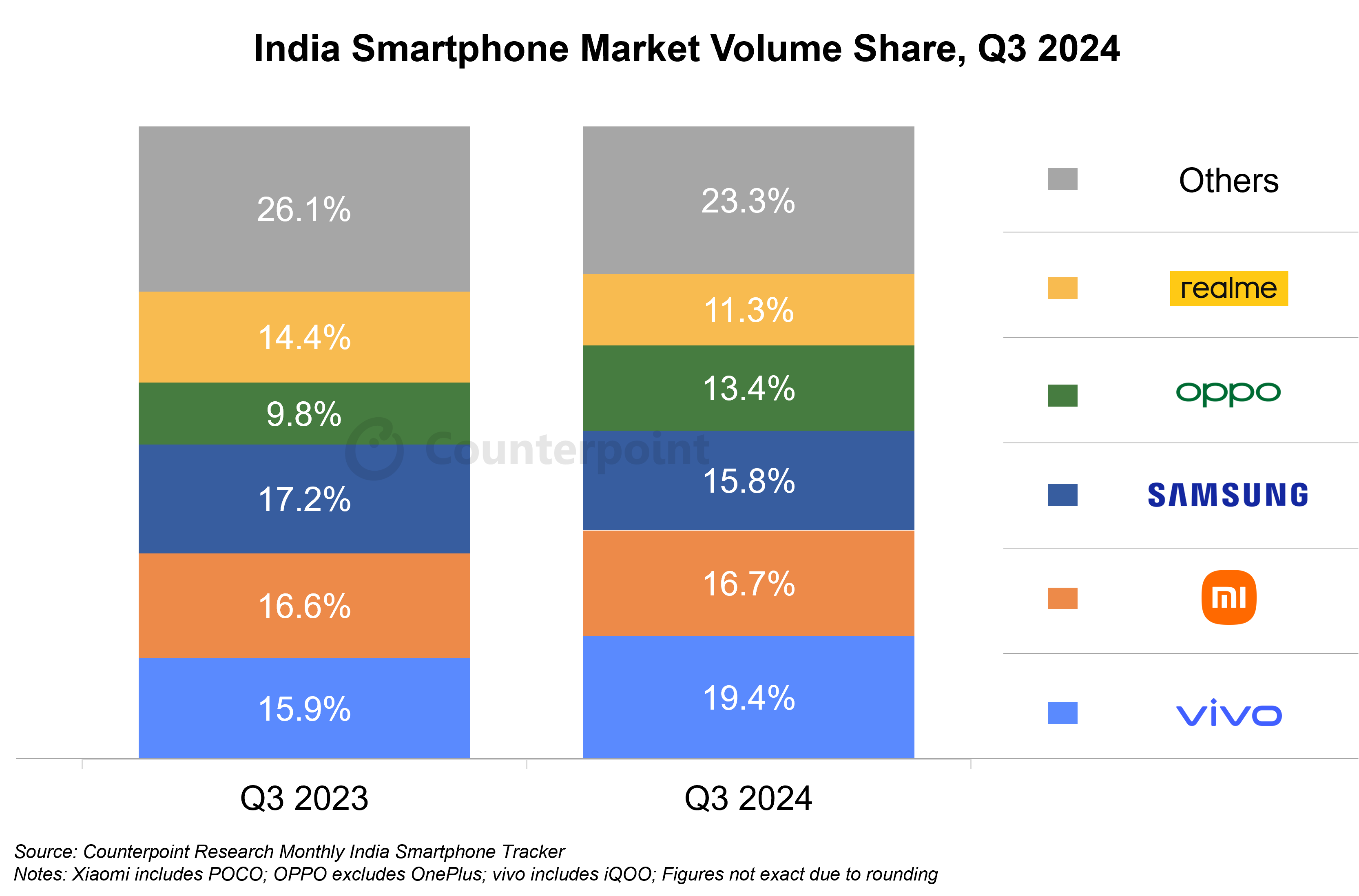

However, the Indian smartphone market grew only 3% year-on-year in the third quarter of 2024 in terms of units, as the Christmas season started earlier than in 2023. “OEMs aggressively filled the channel and ensured strong performance for retailers” – preparing for an expected sales surge during the holiday season. However, festival sales started at a slower pace compared to last year,” the research firm said.

Vivo, ranked No. 1, expanded its share from 16% in Q3 2023 to 19.4% in Q3 2024 due to steady inventory levels throughout the year, and became the market leader with a year-on-year growth of 26%. contributed to regaining its position. The company’s growth was also supported by a diverse product portfolio and successful expansion of the T-series.

Second place Xiaomi grew by 3% year-on-year with a balanced focus across both online and offline channels, increasing its market share from 16.6% in Q3 2023 to 16.7 in Q3 2024 % slightly expanded.

Third place Samsung’s market share shrank from 17.2% in Q3 2023 to 15.8% in Q3 2024. Oppo, in fourth place, captured a 13.4% share of the total sales volume, while Realme, in fifth place, saw its share decrease from 14.4% in Q3 2023. 11.3% from Q3 2023 to Q3 2024.

“Several sales events were held by both OEMs and channels in the third quarter of 2024. These include parallel offline campaigns that helped some OEMs clear existing inventory; This has allowed us to fill the channel with multiple new product launches ahead of the Christmas season,” said Research Analyst Shubham Singh.

He added that Oppo has emerged as the fastest growing brand among the top five. “The brand was supported by new product launches and an aggressive market strategy,” Singh said.

Nothing has been the fastest growing brand for three consecutive quarters, with an impressive 510% annual shipment growth in Q3 2024, driven by portfolio expansion, strategic market penetration, and more than 800 We entered the top 10 for the first time through our partnership with a multi-company. – According to Counterpoint, the brand has outlets in over 45 cities.

Motorola expects to grow 87% YoY in Q3 2024 due to success of affordable models with emphasis on CMF (color, material, finish), growing demand from smaller cities, and market size expansion I recorded my growth.

5G smartphones achieved a record high share of 81% of total shipments. According to the research firm, in the Rs 10,001 to Rs 15,000 segment (approximately $120 to $240), 5G penetration has reached 93%, with brands focusing on introducing 5G models in the lower price segment. It is said that there is.