Like the global mobile industry as a whole, the world’s largest smartphone market continues to expand at a relatively slow but apparently steady pace. Unlike most other companies, Samsung’s presence in China is virtually negligible, and Vivo once again beat out companies from Apple to Huawei to Xiaomi to Honor for another regional sales crown. Obtained.

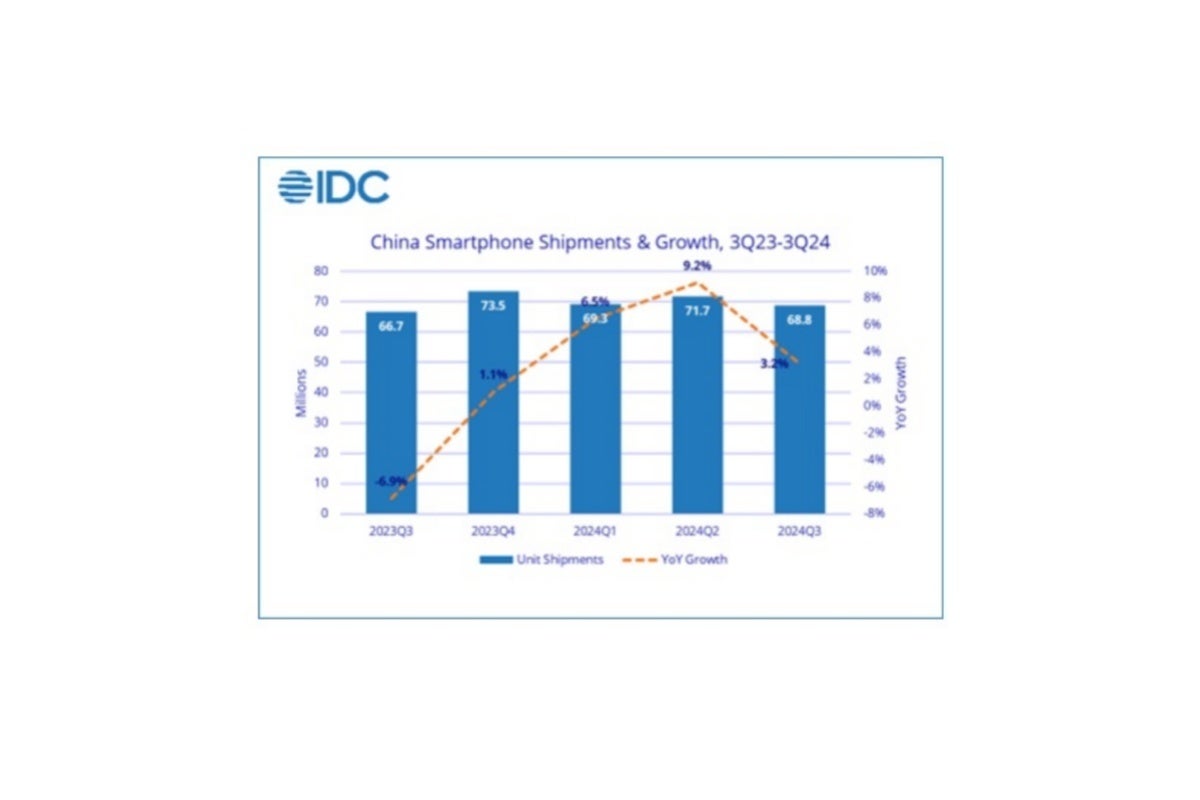

In total, The International Data Corporation (IDC) estimates that 68.8 million smartphones were shipped in China in the third quarter of this year. This represents a small but significant increase of 3.2 percent compared to last year’s third quarter tally. This is the fourth consecutive quarter of progress in the U.S., despite Even after Apple took the podium, market growth continues to be primarily driven by local companies.

Some brands are seeing great progress, while others are a bit stagnant

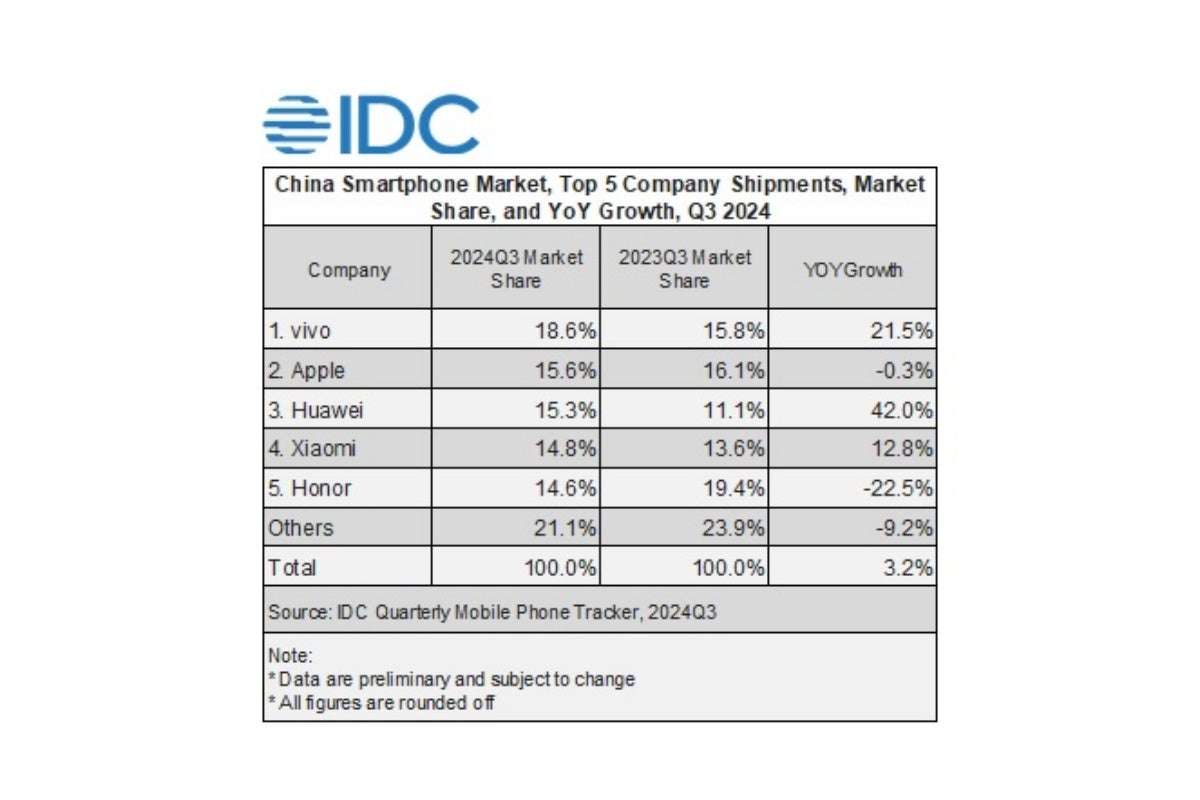

As an example, Vivo maintained its dominant position with a significant 21.5% improvement in sales from Q3 2023. Interestingly, even though Huawei has dropped from a silver medal spot to the bottom of the podium between April and June this year, it has now seen a massive 42 percent increase in shipments compared to Q3 2023. was recorded.

As the leader in the Chinese market, the company enjoys a significant advantage over its four very close rivals.

On the other hand, Apple actually wasn’t anywhere among the top five Chinese smartphone vendors in Q2 2024, so its jump to second place on the Q3 2024 chart is a pretty surprising achievement. It may seem like. On the less bright side of things, the company’s iPhone sales in China are down 0.3% compared to Q3 2023. The iPhone 16 series has been almost as successful as the iPhone 16 series. The iPhone 15 family, but not much more.

Even though it’s worth it, The impending launch of Apple Intelligence and iPhone16 Perhaps the impending promotion could help the Cupertino-based tech giant maintain its position in China’s top three.

What is definitely worth highlighting in IDC’s latest report is that the regional sales differences between Apple, Huawei, Xiaomi, and Honor are very small. Apple currently has a market share advantage of just 0.3% over Huawei, while Xiaomi managed to reach 30% in Q3 2024, even though the latter brand had a huge advantage with nearly 6% share a year ago. It succeeded in outperforming Honor by 14.8% to 14.6%.

What’s in store for Apple and its rivals?

This is clearly an incredibly competitive market and will continue to be a very even battle for the foreseeable future. And if Apple wants to catch up with its Chinese rivals; The iPhone 17 lineup, especially iPhone SE 4 has to introduce something new and innovative. Either that or the unbeatable value equation.

China’s smartphone market has continued to grow in recent quarters, and may continue to do so for several more quarters.

Otherwise, it will certainly be difficult to fend off Huawei, which has essentially risen from the brink of death stronger and more ambitious than ever, with (among other things) an impressive foldable portfolio that already includes Probably. The world’s first tri-fold model.

The threat of Xiaomi and Honor should not be ignored either, with the former company aiming to “push the boundaries” of the high-end segment while maintaining its main focus on budget-friendly, and the latter brand (less profitable). (despite not being expensive) dominates huge brands. Price range from $100 to $200.

Of course, Vivo and Honor have important regional advantages over Apple and global advantages over Samsung in surprisingly affordable foldable high-end products. These products are becoming increasingly popular in China (and throughout many major European markets).