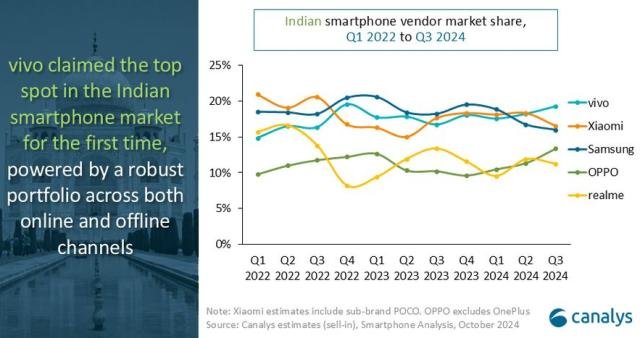

Vivo secured the top spot in the Indian smartphone market for the first time, with 9.1 million units shipped and 19% market share in Q3 2024.

The Indian smartphone market grew by 9% in Q3 2024 with 47.1 million units shipped. Smartphone vendors focused on clearing stocks during the early monsoon sale period in preparation for the upcoming Christmas season. However, rising food inflation and weak urban spending dampened early festival demand, impacting the market.

Vivo:

Shipments: 9.1 million units (up from 7.2 million units in Q3 2023).

Market share: increased from 17% to 19%.

Annual growth rate: 26%.

Vivo has experienced significant growth and achieved the top spot in India for the first time. This growth was driven by aggressive promotion across both online and offline channels and a focus on higher-end models.

Sanyam Chaurasia, senior analyst at Canalys, credits the rise of Vivo’s channel strategy to its new product launches at higher price points.

Xiaomi was a close second with 7.8 million units shipped, benefiting from its low-cost 5G lineup.

Xiaomi:

Shipments: 7.8 million units (slight increase from 7.6 million units in Q3 2023).

Market share: Slightly decreased from 18% to 17%.

Annual growth rate: only 3%.

Xiaomi maintained a strong position but did not see significant growth compared to its competitors. The slight decline in market share shows that although the company remains strong in the lower-end 5G segment, it is losing ground to more aggressive competitors such as vivo and OPPO.

Samsung secured third place with 7.5 million units.

Samsung:

Shipments: 7.5 million units (down from 7.9 million units in Q3 2023).

Market share: decreased from 18% to 16%.

Annual growth rate: -4%.

Samsung has seen declines in both unit shipments and market share, suggesting it is under pressure from aggressive competitors such as vivo and Xiaomi. The company may need to rethink its strategy to remain competitive in a price-sensitive market.

OPPO and realme rounded out the top five, shipping 6.3 million and 5.3 million units, respectively.

Oppo:

Shipments: 6.3 million units (up from 4.4 million units in Q3 2023).

Market share: increased from 10% to 13%.

Annual growth rate: 43% is the highest among the top 5 vendors.

OPPO’s impressive growth highlights the company’s success in expanding its online presence and launching competitive mid-range to high-range smartphones. This aggressive strategy paid off and allowed us to quickly gain market share.

OPPO also leveraged its expanded online portfolio, such as the T3 and K12 series, to increase sales volumes beyond its traditional offline strengths. The overall market saw an expansion in mid- and high-end products as brands expected to clear stocks during the festive sale.

Meanwhile, brands outside the top five, including Apple, Motorola, Google, and Nothing, had strong quarters. Apple specifically recognized strong demand for the iPhone 15 from smaller cities.

Inventory buildup due to sluggish festival demand

Canalys emphasized that most vendors are actively shipping devices to meet festival demand, but weak traction could lead to inventory piling up. The higher-priced models were favored by replacement and upgrade buyers due to their mid-to-luxury offering, trade-in deals, and financing options. However, entry-level demand was weak as rising prices caused consumers to delay purchases.

According to a study by Canalys, the Indian smartphone market is expected to witness significant growth in the sub-₹10,000 5G segment in 2025.

As competition from feature phones and the second-hand market remains strong, brands will need to offer more than just 5G capabilities to attract consumers in this segment. Canalys projects only single-digit growth in 2025.

Baburajan Kijakedas