Apple celebrates the 10th anniversary of Apple Pay today, and it’s clear that the Cupertino-based giant is pretty happy with its payment service. I’ll be the first to admit that Apple Pay will still be useful and convenient 10 years later. Most of the time, you double-tap the power button on your iPhone to pay instead of reaching for a physical card.

In the years since its initial launch, more card partners have emerged and more retailers have adopted the standard. WWDC 2024 introduced new payment methods including Rewards, and these methods are now available in iOS 18, with more partners being announced. Overall, it’s a new way to pay with Apple Pay.

You’ll now be able to check out with Apple Pay and redeem eligible card benefits, including miles and points from the U.S. Discover credit card. You will also have access to installment loans from Affirm in the US and Monzo Flex in the UK. Flexible payment options with Klarna in the US and UK.

Pay with rewards or two new payment options

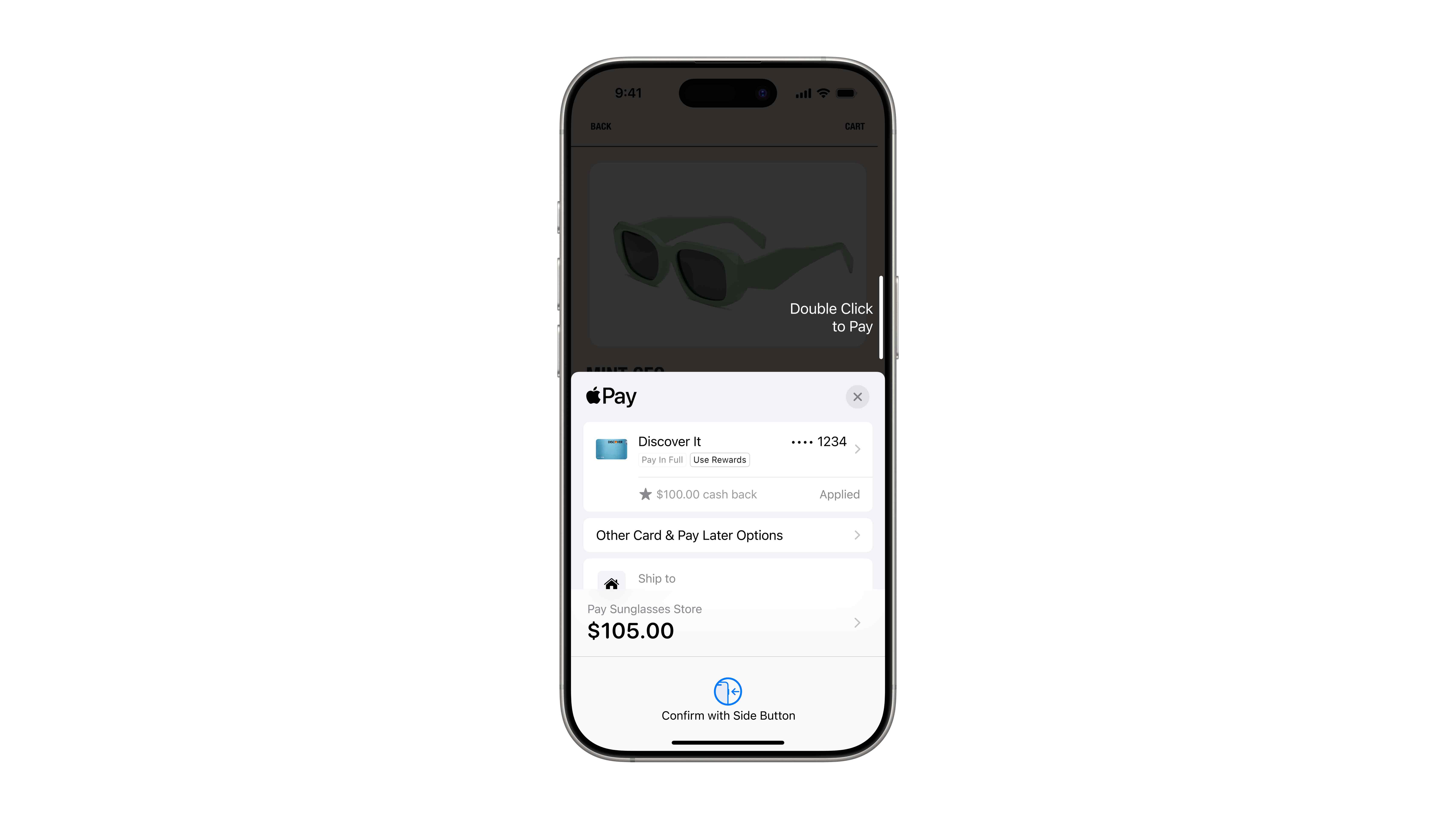

iOS 18 is now available for people with an iPhone or iPad in the U.S., and you can select rewards like points (think cashback) and miles from eligible Discover cards at checkout. You will be able to pay in full or in part at any time. Apple has integrated this option directly into the checkout screen (which occupies part of the bottom of the device), and it feels very intuitive. By default, the maximum amount you can redeem is displayed and you can adjust the amount by tapping on it.

But even more subtle, by solving just one part of the puzzle of the value of airline miles, you can also get the dollar-for-dollar equivalent value of a mile. It’s quite convenient. This experience of using card benefits at checkout with Apple Pay is currently rolling out with some Discover cards, but will be rolled out to more partners in the future. Apple has confirmed that the benefit is available on select Synchrony, Fiserv, and FIS cards in the US and DBS cards in Singapore.

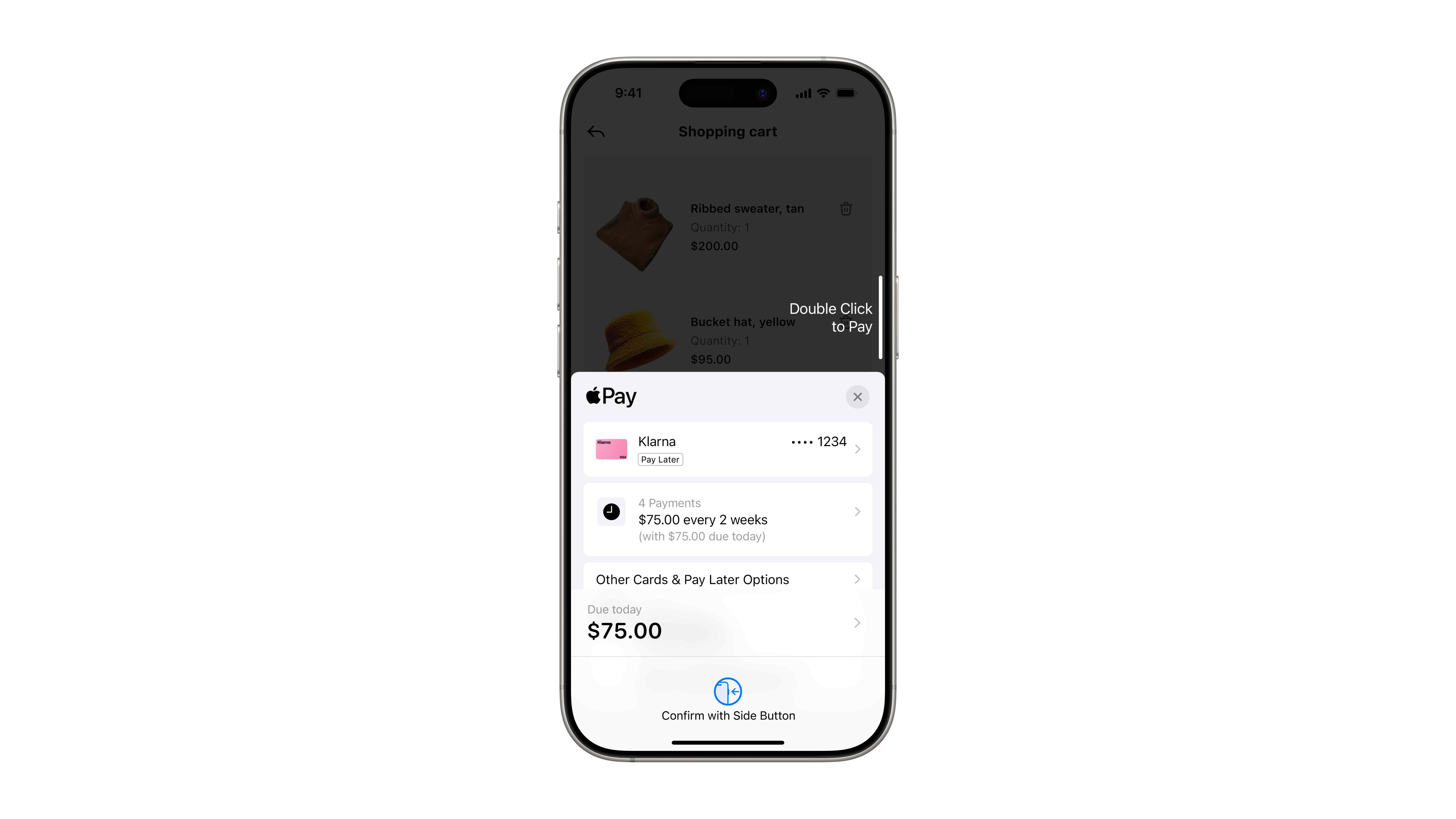

But beyond the perks, Apple is also adding two new payment options, the first of which is considered Apple’s successor partner since Apple Pay Later was shut down. First, Klarna’s flexible payment options are now available in the US and UK to people checking out with Apple Pay on iPhone and iPad, online and in-app. Select your service as a payment option, get approved, and let us choose a plan to split your payments. Please note that charges do not occur weekly or biweekly (varies for each payment option). In these cases you will need access to the Klarna app.

Second, iOS 18 also adds installment loan payment options. In the US these are done through Affirm and in the UK through Monzo. These allow you to get approved for a loan, select your terms, see which terms have interest associated with them, and complete the checkout process. This is a pretty big step and a direct replacement for Apple’s own “Apple Pay Later” installment plans. We also plan to expand to several other countries at some point in the future, including ANZ in Australia and CaixaBank in Spain.

Overall, these new payment methods and new partners will liven up the Apple Pay experience a bit. It’s also important that we don’t change the ease of use that makes Apple Pay a great service and feature for Apple’s myriad devices. Adding perks like points and miles to the Apple Pay checkout process is very convenient and allows many people to make better use of their points, similar to how you can checkout with points on Amazon. I think it will be like this. However, it may wear out faster.