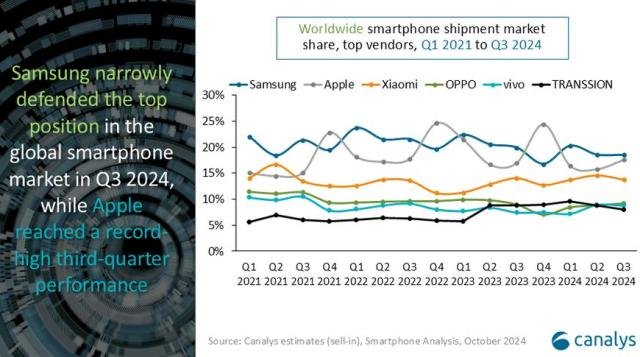

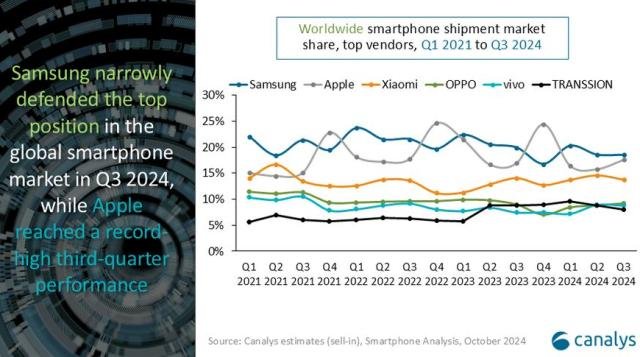

According to Canalys’ latest research, smartphone shipments in Q3 2024 increased by 5% year-on-year, marking the fourth consecutive quarter of growth. This surge is being driven by a recovery in demand in emerging markets and the start of replacement cycles in North America, China and Europe.

Apple reached a significant milestone this quarter, increasing its market share to 18% from 17% in Q3 2023. This growth has brought Apple on par with Samsung, whose market share has fallen from 21% to 18%. Apple’s strong performance is due to the iPhone 15 series and its legacy models, with Q3 2024 sales being the highest Q3 ever.

Samsung’s smartphone market share increased from 18% in Q3 2024 to 21% in Q3 2023.

Additionally, Apple’s smartphone market share was 17% in Q3 2023, compared to 18% in Q3 2024.

Xiaomi’s smartphone market share was 14% in Q3 2024, and 13% in Q3 2023.

Oppo’s smartphone market share rose from 9% in Q3 2024 to 10% in Q3 2023.

Apple’s success was driven by a market shift towards premium devices and refresh cycles for devices purchased during the pandemic. In regions such as North America and Europe, Apple continues to dominate, with the iPhone 16 expected to gain further momentum in the first half of 2025. Apple’s diversification strategy, which helped shorten lead times, combined with its expanding Apple Intelligence services, strengthened its position.

Le Xuan Chiew, an analyst at Canalys, said, “The gap between the top vendors has narrowed,” highlighting the intensification of competition. As the holiday season approaches, vendors are gearing up for major shopping events like 11.11 and Black Friday to capture the attention of consumers waiting for deals.

Apple is closer than ever to leading the global smartphone market during the third quarter, although other manufacturers such as Xiaomi, Oppo, and Vivo have also shown slight increases or stability in market share.